Artificial intelligence (AI), shareholder meeting format, executive pay, independence and board nominee disclosure practices have been included as key updates in Glass Lewis’ 2025 Proxy Voting Guidelines (Guidelines) and in Institutional Shareholder Services (ISS) proposed 2025 guidelines (Proposed Guidelines).

Glass Lewis’ updated Guidelines will apply to shareholder meetings beginning on January 1, 2025 and once final, ISS’ Proposed Guidelines are expected to apply to shareholder meetings beginning on February 1, 2025.

Takeaways

Directors of Canadian publicly traded companies should take note of the following updated guidance from Glass Lewis for the 2025 proxy season:

- Boards should be aware of and mitigate any material risks that could arise from their use or development of AI.

- Proxy circular disclosure should include a clear rationale for the issuer’s choice of shareholder meeting format when in-person attendance is not permitted.

- S&P/TSX 60 Index constituents are expected to provide sufficient disclosure of the experience and expertise of board nominees to facilitate shareholder decision making and assessment of nominees.

While yet to be finalized, issuers should also consider the following Proposed Guidelines published by ISS for the 2025 proxy season:

- Articles and by-laws that give the board discretion to hold shareholders’ meetings in virtual-only format without a compelling rationale will receive a negative voting recommendation, even if the article or by-law amendment before shareholders is unrelated to meeting format.

- Former CEOs will be deemed non-independent unless a five-year cooling off period can be justified.

- Non-independent former CEOs and CFOs are restricted from membership on audit and compensation committees.

Artificial Intelligence and shareholder meeting format to hold the attention of proxy advisors in 2025

Artificial intelligence

Recently, companies have begun developing and deploying AI technologies throughout various aspects of their businesses. In its updated Guidelines, Glass Lewis notes that AI technologies have the potential to make companies’ operations and systems more efficient and productive, however, there are many potential risks associated with the use of AI technologies.

While the technology offers unprecedented opportunities to boost productivity and innovation, it also presents unique challenges, especially in the areas of data managements and security, intellectual property, compliance and legal liability, as well as ethical and reputational concerns. Ensuring that proper ethical consideration has been given to the implementation of AI in the business, including reviews of the underlying data for bias and fairness, boards must take responsibility for requiring management to address the short and long-term challenges of matching up the promise of AI technologies with the business’ goals.

Given the potential risks, Glass Lewis expects that boards be aware and take active steps to mitigate exposure to, any material risks that could arise from their use or development of AI. Companies that develop or use AI technologies should consider adopting strong internal governance frameworks that include ethical considerations and ensure that they have provided a sufficient level of oversight of AI. Establishing clear, enforceable AI governance frameworks is the best way to ensure organizations are prepared for tomorrow’s challenges.

In order to provide sufficient oversight, Glass Lewis encourages boards to engage in continued board education and/or nominate directors with AI expertise. Further, Glass Lewis encourages companies who develop or use AI in their operations to provide clear disclosure concerning the role of the board in overseeing issues relating to AI.

For 2025, Glass Lewis will not make voting recommendations solely on the basis of a company’s AI oversight practices and disclosure, unless there is a material incident related to the issuer’s use or management of AI-related issues. Glass Lewis may, however, recommend against individual directors responsible for managing AI risk where insufficient oversight and/or management of AI technology has resulted in material harm to shareholders.

While Glass Lewis will focus on AI related disclosure and risk management in the 2025 proxy season, issuers are also reminded that disclosure related to their use and development of AI should follow best disclosure practices, including ensuring that such disclosure is factual and balanced to avoid AI washing.

BLG has assembled a comprehensive checklist of topics for consideration for boards and management of Canadian companies as they look to strategically leverage AI.

Guidance on virtual-only meetings

The debate as to whether companies should continue to hold their shareholder meetings in a virtual-only format versus a hybrid or in-person only format will continue into the 2025 proxy season. As discussed in a previous bulletin, Shareholder advocates argue that the virtual-only format allows companies to control shareholder meetings and effectively limit shareholder participation at the meetings by ignoring or curating shareholder questions submitted, by responding to questions with boilerplate statements and preventing shareholders from openly challenging management and the board. On the other hand, some argue that since shareholders rarely attend in person meetings, that the virtual format increases shareholder engagement by providing stakeholders with an equal opportunity to engage with the company regardless of their physical location.

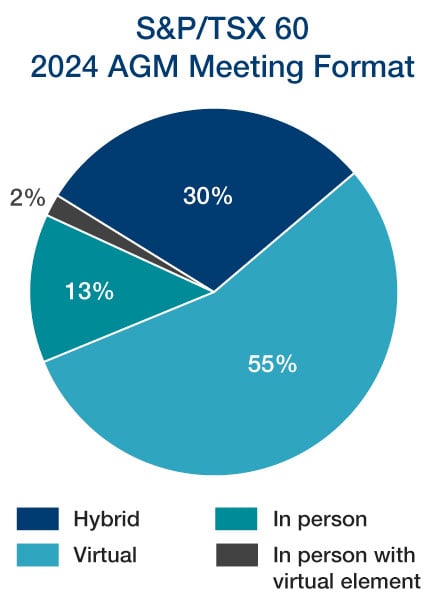

Earlier this year, the British Columbia General Employees’ Union brought together a number of institutional investors to sign a letter calling on some of Canada’s largest issuers to act to safeguard shareholder rights at virtual meetings. The letter urged Canadian issuers to publicly disclose, both well in advance and in their proxy materials, their plans to uphold shareholder rights at virtual-only or hybrid shareholders’ meetings. In addition, Mouvement d’éducation et de Défense des actionnaires (MÉDAC) submitted a number of shareholder proposals to several large Canadian issuers during the 2024 proxy season, calling upon them to hold their annual shareholders’ meetings in-person to safeguard the rights of shareholders. MÉDAC recently published the results of the votes on their shareholder proposals which received greater than 50 per cent support from the shareholders of five large Canadian issuers proving that there is significant support from shareholders for hybrid or in-person meetings. The Canadian Coalition for Good Governance (CCGG) has also advocated against virtual only meetings and in favour of hybrid and in-person meetings. Notwithstanding this debate, in the 2024 proxy season, the majority of issuers in the S&P/TSX 60 still held virtual only meetings.

Going forward, Glass Lewis expects companies to disclose the reasons for which the board has elected to hold shareholder meetings in a virtual-only format. In line with previous guidance from the Canadian Securities Administrators and CCGG, Glass Lewis expects companies holding virtual-only meetings to provide robust disclosure in their proxy statement which assures shareholders that they will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

In cases where the board is planning to hold a virtual-only shareholder meeting and the company does not provide adequate disclosure, the disclosure provided is ambiguous or where a board has failed to address legitimate, publicly disclosed shareholder concerns regarding the shareholder meeting format, Glass Lewis may recommend that shareholders vote against the re-election of the governance committee chair or other accountable directors.

While ISS has not taken a firm position on meeting format, ISS has proposed that it will recommend against amendments to articles or bylaws where the resulting document gives the board of directors discretion to holder shareholders’ meeting in virtual-only format without compelling rationale.

Executive pay, independence and board nominee disclosure

Glass Lewis has added some clarifying amendments to its commentary on executive compensation to emphasize that it takes a holistic approach to analyzing executive compensation programs. In general, Glass Lewis expects comprehensive, timely and transparent disclosure of executive pay in order to allow shareholders to evaluate the extent to which executive pay is appropriate and keeping pace with a company’s performance.

Glass Lewis recognizes that there are a few features of its say-on-pay program that, on their own, lead to an unfavourable recommendation for a say-on-pay proposal since pay programs are reviewed on a case-by-case basis by Glass Lewis. Since Glass Lewis does not use a pre-determined scorecard approach when considering individual features such as the allocation of the long-term incentive between performance-based awards and time-based awards. Certain unfavourable factors in a company’s pay program will be reviewed by Glass Lewis in the context of the rationale, overall structure, overall disclosure quality, the program’s ability to align executive pay with performance and the shareholder experience and the trajectory of the pay program resulting from changes introduced by the compensation committee from year to year.

Additionally, Glass Lewis expects that companies will disclose sufficient information to allow for a meaningful assessment of a nominees skills and competencies. In cases where the disclosure of a S&P/TSX 60 company does not allow for a meaningful assessment of the key skills and experience of incumbent directors and nominees, Glass Lewis will consider recommending voting against the chair of the nominating committee (or the equivalent) under its Guidelines.

Having an appropriate mix of certain attributes on the board – in particular skills, experience, diversity and independence – is essential to ensure that a board as a whole can satisfactorily perform its oversight duty, have informed opinions on all topics relevant to a company and effectively advise management on important strategic issues. In the Board Skills Appendix to its Guidelines, Glass Lewis notes that best practices with regards to board nominee disclosure should include detailed descriptions of nominees in which companies convey the skills sets of their directors in terms of their relevance to company strategy and the board’s operations, rather than simply listing a nominee’s past board positions. Companies should incorporate a board skills matrix into their disclosure as this can be a valuable tool for assessing a board’s mix of skills and experience and help guide shareholders’ understanding of a board’s nomination and succession planning processes. In circumstances where a board has failed to address material concerns regarding the mix of skills and experience of the non-executive members of the board, Glass Lewis will consider recommending voting against the chair of the nominating committee (or the equivalent) under its Guidelines.

For 2025, Glass Lewis has also clarified that they expect governance committees on all TSX boards to meet at least once during the year in review and in cases where that fails to be the case, its Guidelines will generally recommend against the chair of the committee in question or, in the absence of a chair, the senior member of said committee.

In their Proposed Guidelines, ISS has clarified that a former chief executive officer will be deemed as non-independent, unless circumstances exist which make a five-year cooling off period sufficient and will continue to recommend against non-independent former chief executive officers as members of the audit and/or compensation committees. Furthermore, ISS proposes that it will use the compensation of a named executive officer in its pay-for-performance model other than that of a chief executive officer in circumstances where the compensation of such named executive officer is regularly significantly higher than that of the chief executive officer.

Next steps

As the 2025 proxy season is fast approaching, we encourage boards to consider their governance and disclosure practices, including how the Guidelines and Proposed Guidelines may impact the issuer and any board nominees.