The article below relates to a decision of the Supreme Court of Canada involving Deans Knight Income Corp., which is a separate legal entity from Deans Knight Capital Management Ltd. We understand that the decision has no financial or operational impact on the business of Deans Knight Capital Management Ltd..

By Steve Suarez, Laurie Goldbach & Elizabeth Egberts, BLG1

On May 26, 2023, the Supreme Court of Canada (SCC or the Court) dismissed the taxpayer’s appeal in Deans Knight Income Corp. v Canada, 2023 SCC 16 (DKIC v. Canada). This much-anticipated decision deals with the general anti-avoidance rule (GAAR) in section 245 of the Income Tax Act2 (Act). Where applicable, GAAR allows the Canada Revenue Agency (CRA) to redetermine the tax consequences of a transaction. For GAAR to apply, the taxpayer must have engaged in a transaction or series of transactions with the primary purpose of obtaining a tax benefit, in such a manner as to result in an abuse or misuse of one or more provisions of the Act. To date, relevant jurisprudence has established that a two-stage GAAR analysis be employed to determine whether a transaction is abusive. First, the court determines the object, spirit and purpose (OSP) or legislative rationale of the relevant provisions of the Act. Second, the court decides whether a specific transaction has frustrated or abused that OSP or legislative rationale.

DKIC v. Canada considered the potential application of GAAR to transactions specifically designed to avoid triggering s. 111(5) and related provisions (collectively referred to herein as the corporate loss restrictions), which restrict a corporation that has undergone an “acquisition of control” (AOC) from using its pre-AOC accumulated business losses in post-AOC taxation years.3 These rules interpret “control” as de jure control: the ownership or control over the voting rights of such a number of the corporation’s shares as would entitle the owner/controller to elect a majority of the corporation’s board of directors.4 The taxpayer in DKIC v. Canada had been a public corporation that accumulated $90 million of business losses,5 which it sought to monetize via a series of transactions carefully designed to avoid creating a de jure AOC, thus preserving its ability to utilize those losses.

Key takeaways

In a 7-1 decision, the Supreme Court ruled that the taxpayer had contravened the legislative rationale of the corporate loss restriction regime, because an unrelated third party had acquired the “functional equivalent” of de jure control, in this case by means of contractual arrangements that would not (outside of GAAR) be relevant in determining de jure control. In so ruling, the Court established the de jure control standard as the threshold inherent in the OSP of the corporate loss restriction rules and, critically, rejected the use of a lower threshold of ‘actual control’ or ‘effective control’ as suggested by the lower courts and the Crown. Justice Côté in dissent, opined that the majority’s introduction of “functional equivalence” ignores the ‘radically different’ ways these share voting rights and contractual agreements are enforced and results in the Court overriding Parliament’s clear intent and articulation of a de jure control test.

DKIC v. Canada represents an endorsement of the continued application of long-established legal principles and a refinement of the approach to GAAR analysis without disturbing prior GAAR jurisprudence. As such, DKIC v. Canada does not significantly change the legal framework of GAAR, as the Court’s reasoning is rightfully tethered to the de jure standard used in the corporate loss restriction rules and does not establish new legal principles, and the result of the case itself is largely fact-specific. From a practical perspective however, DKIC v. Canada illustrates that if a taxpayer achieves an outcome highly similar to (or in this case, found to be “functionally equivalent” of) that at which a particular provision is directed, there is a very significant risk that it will be found to have come within the legislative rationale of that provision with the result that GAAR applies.

DKIC v. Canada shows that courts are not hesitant to apply GAAR in a flexible and broad way to prevent outcomes they perceive to be contrary to Parliament’s intent. To the extent any justification previously existed for the government’s proposed legislative amendments to GAAR announced in the federal budget of March 28, 2023, DKIC v. Canada decisively negates it. The existing GAAR jurisprudence, endorsed and refined by DKIC v. Canada, is already performing the very functions that these legislative amendments to GAAR relating to abuse and misuse purport to address. We invite the government to rethink its proposed GAAR reform, following this clear indication from the Court.

Facts

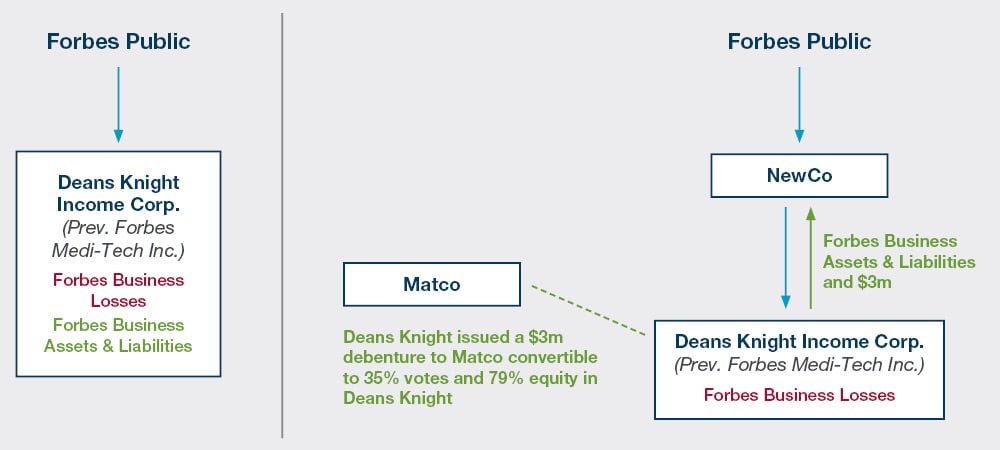

The taxpayer, Deans Knight Income Corp. ("DKIC"), began as a publicly-listed drug research and food additives company that experienced financial difficulty and underwent a reorganization under which it became a wholly-owned subsidiary of a new widely-held and publicly-traded corporation (NewCo). NewCo and DKIC entered into an agreement (the Investment Agreement) with an unrelated third party (Matco) under which:

- in exchange for $3 million, DKIC issued a debenture to Matco convertible into 35 per cent of its voting shares plus non-voting shares that collectively represented 79 per cent of DKIC’s equity;

- DKIC ’s business and the $3 million were transferred to NewCo, effectively leaving DKIC “a shell with no assets and one liability: an obligation to pay principal and interest to Matco under the convertible debenture”;6 and

- Matco agreed to use its expertise to arrange a corporate opportunity for DKIC whereby new funds would be raised in an initial public offering so as to avoid triggering an acquisition of de jure control of DKIC under s. 111(5), such funds to be used to establish a business whose income would be sheltered by DKIC’s tax losses; and

- Matco was obligated within a year to pay another $800,000 to NewCo (either to acquire NewCo’s DKIC shares or otherwise).

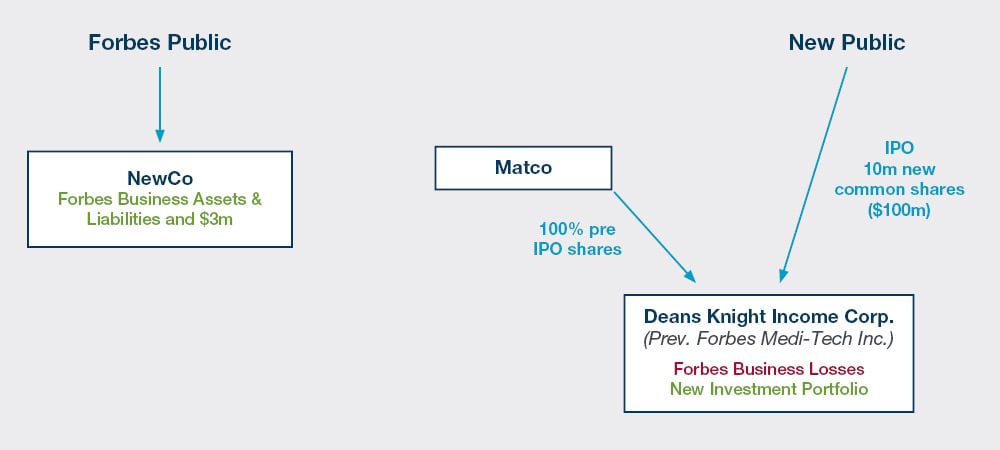

Eventually, Matco arranged a $100 million IPO of DKIC under which the money raised would be managed by DKIC Capital Management Ltd. and used to earn income from corporate debt securities, which was sheltered from tax using DKIC ’s accumulated $90 million of tax losses and similar deductions and credits from 2009-2012. Matco exercised its conversion right to convert the DKIC ’s debenture into voting and non-voting shares and purchased NewCo’s shares of DKIC for the agreed $800,000. The result was that NewCo received a total of $3.8 million for the DKIC shares, and Matco’s publicly-traded DKIC shares following the IPO were worth $5 million.

The Lower Court decisions

Tax Court of Canada

In considering the application of the GAAR, the Tax Court of Canada (TCC) found the first stage of the GAAR test was met, such that the taxpayer derived a tax benefit from the transactions at issue. On the second stage of the GAAR test, the TCC found that the primary purpose of the transactions was to “monetize” the taxpayer’s tax attributes, creating an “avoidance transaction”. In determining the relevant OSP of the relevant provisions, the TCC held that:7

- the OSP of paragraph 111(1)(a) (which allows a taxpayer to use business losses from one year against income in a later year) is “to provide relief to taxpayers who have suffered losses, given that the government, through income tax, shares in the income of a taxpayer”;

- the OSP of subsection 111(5) is “to target manipulation of losses of a corporation by a new person or group of persons, through effective control over the corporation’s actions”; and

- the OSP of paragraph 256(8) is “to prevent a taxpayer from circumventing the listed avoidance provisions by acquiring control over shares or share voting rights in order to achieve effective control of the corporation”.

In applying these legislative rationales, the TCC found that the tax benefit achieved was not abusive, largely because in the TCC’s view “Matco simply did not have effective control over [DKIC] or need such control to make the arrangement work”.8

Federal Court of Appeal

The Crown appealed the TCC’s decision to the Federal Court of Appeal (FCA). In a unanimous ruling, the FCA concluded that the transactions at issue constituted an abuse of s. 111(5), thereby causing GAAR to apply such that the taxpayer’s use of its accumulated pre-AOC losses was restricted by the rules in the corporate loss restriction regime.

The FCA agreed with TCC’s view that the OSP of subsection 111(5) is “to target manipulation of losses of a corporation by a new person or group of persons, through effective control over the corporation’s actions”. However, to add clarity to the concept of “effective control”, FCA reformulated the OSP of these provisions as follows:

[72] However, the Tax Court’s statement of the underlying rationale of subsection 111(5) lacks clarity. This was evident in the submissions before this Court on what the Tax Court meant by “effective control”. I would rearticulate the object, spirit and purpose of subsection 111(5) as follows: it is to restrict the use of specified losses, including non-capital losses, if a person or group of persons has acquired actual control over the corporation’s actions, whether by way of de jure control or otherwise.

. . .

[93] For these reasons, I conclude that the object, spirit and purpose of subsection 111(5) is, at least in part, to restrict the use of specified losses, including non-capital losses, if a person or group of persons has acquired actual control over the corporation’s actions, whether by way of de jure control or otherwise.

The FCA further clarified that the TCC did not mean “effective control” to be a synonym for de jure control, and introduced “actual control” as a replacement term ostensibly to avoid confusion.9 In so doing, the FCA effectively created a new AOC standard inherent in the legislative rationale of s. 111(5), stating as follows:

[83] It is true that the object, spirit and purpose of subsection 111(5) as articulated above does include forms of de jure and de facto control. However, the actual control test is different than the statutory de facto control test in subsection 256(5.1) of the Act. Moreover, it must be remembered that the GAAR is intended to supplement the provisions of the Act in order to deal with abusive tax avoidance. I see nothing inconsistent with the conclusion that the object, spirit and purpose of subsection 111(5) takes into account different forms of control even though the text of the provision is limited to de jure control.

DKIC applied for leave to appeal to the Supreme Court, citing the issues as being of broad applicability and concern to a wide variety of Canadian taxpayers. The Supreme Court granted leave to appeal on March 10, 2022, on the issues formulated by DKIC as follows:

- did the FCA err in relying on the GAAR to conclude that "actual control" was Parliament's intended test under ss. 37(6.1), 111(5) and 127(9.1); and

- did the FCA err in concluding, contrary to the trial judge's findings, that the avoidance transactions resulted in an abuse of ss. 37(6.1), 111(5) and 127(9.1)?10

SCC: The judgment

In a 7-1 Judgment penned by Justice Rowe, the Supreme Court found that the transactions at issue were abusive such that the GAAR applied to deny the tax benefit.

The Court began with a review of various principles on the application of GAAR previously established in the jurisprudence, observing that while some uncertainty is unavoidable with the application of a general provision such as GAAR, a reasonable degree of certainty is achieved by the balance within GAAR itself. The Court reiterated the familiar three-step test, being to determine whether: (1) there was a “tax benefit”; (2) the transaction giving rise to the tax benefit was an “avoidance transaction”; and (3) the avoidance transaction was abusive.

The Court stated that when determining the OSP of a provision, it is critical to distinguish the rationale behind the provision from the means chosen by Parliament to give effect to the rationale. Further, the Court held that while this analysis requires a review of the text, context, and purpose of the relevant provision, the courts must ask how the text sheds light on what the provision was designed to achieve and what it shows regarding Parliament’s underlying concerns, and should focus on the relationship between the provision alleged to have been abused and the particular scheme within which it operates.

Here, the Court determined that a review of s. 111(5)’s text, context, and purpose revealed that its underlying rationale was to deny loss carryovers when there is a lack of continuity within the corporation, as measured by both the identity of its controlling shareholder(s) and its business activity. However, the Court held that s. 111(5)’s rationale is not fully captured by the de jure test and is, instead, illuminated by related provisions which both extend and restrict the circumstances in which an AOC has occurred, including by looking beyond the standard documentation under the de jure control test. The Court held that, taken together, the OSP of s. 111(5) is to prevent corporations from being acquired by unrelated parties in order to deduct the corporation’s unused losses against income from another business for the benefit of new shareholders.11

Upon reviewing the transactions at issue, the Court determined that the parties achieved the outcome Parliament sought to prevent as the transactions allowed Matco (an unrelated third party) to achieve the “functional equivalent” of a de jure AOC of the taxpayer through the Investment Agreement with DKIC, while circumventing s. 111(5).

Specifically, the Court held that:

- Matco contracted for the ability to select DKIC’s directors;

- the Investment Agreement placed severe restrictions on the powers of the board of directors which, but for a circuit-breaker transaction that occurred, would normally occur through a unanimous shareholders agreement and which would lead to an acquisition of de jure control; and

- the transactions allowed Matco to reap significant financial benefits while depriving DKIC’s legal majority voting shareholder of each of the core rights that could ordinarily have exercised. In the Court’s view, any residual freedom DKIC had left to it was illusory because it was prohibited from engaging in any activity other than studying and accepting corporate opportunity, and because the consequences of refusing the opportunity were severe.

SCC: The dissent

Dissenting, Justice Côté opined that the appeal ought to have been allowed and that the Court’s decision constituted an ad hoc approach that expands the concept of control based on a wide array of operational factors despite Parliament’s unambiguous adoption of the de jure control test in s. 111(5). Justice Côté reasoned that the Court’s approach to determining the OSP of s. 111(5) failed to account for the central principle that the GAAR does not and cannot override Parliament’s specific intent regarding provisions of the Act. Justice Côté reiterated previous jurisprudence that a GAAR analysis must rely on the same interpretive approach employed by the Supreme Court in all questions of statutory interpretation. In such an interpretation, the text of a provision can, in certain circumstances, is conclusive. This is especially true for specific anti-avoidance rules such as s. 111(5) where the key question is whether Parliament specifically intended to prevent or permit a certain type of transaction.

Applying this interpretative approach, Justice Côté determined that the OSP of s. 111(5) is to restrict the use of tax attributes by an unrelated third party if accessed through an acquisition of de jure control. In formulating the legislative rationale of the corporate law restriction rules, Parliament never intended courts to consider factors other than those related to share ownership in determining who has control over a corporation. Further, Justice Côté argued that the Court’s introduction of “functional equivalence”, which treats an investment agreement as a constating document, ignores the ‘radically different’ ways these types of agreements are enforced and results in the Supreme Court overriding Parliament’s clear intent and articulation of a de jure control test for restricting losses under s. 111(5).

Commentary

A refinement of established GAAR jurisprudence

Fundamentally, the Court’s decision in DKIC v. Canada does not tell us much that is new about how to interpret or apply GAAR and, instead, represents a further refinement on the established jurisprudence. Much of the Judgment reviews the existing law with respect to GAAR. Specifically, the Court reiterated the familiar three-part test and confirmed the need to determine the OSP of the relevant provisions when considering whether an avoidance transaction constitutes a misuse or abuse of those provisions under the Act.12

There is nothing new or controversial in the Court’s holding that “there is no bar to applying the GAAR in situations where the Act specifies precise conditions that must be met to achieve a particular result, as with a specific anti-avoidance rule” (para. 71). As the Court itself notes, prior GAAR cases have taken the same position. The Court’s holding “that specific and carefully drafted provisions are not immune from abuse” (para. 72) is one that no one seriously contests, though the process that is used to determine the OSP continues to evolve.

While the Court’s determination of the OSP of the corporate loss restrictions at issue may be of limited precedential value due to the subsequent amendments to those rules, the Judgment makes it clear that the Court saw fit to endorse and modestly refine the existing GAAR analysis. It is hence reasonable to conclude then the Court considers GAAR to be up to the task Parliament intended it to fulfil and not in need of significant changes.13

The Supreme Court rejects the ‘actual control’ test

The Judgment achieves a couple of key objectives. First, it firmly rejects the ‘actual control’ and ‘effective control’ formulations of the OSP of s. 111(5) set out in the FCA and TCC decisions respectively. The ‘actual control’ standard, which purported to include elements of both de jure and de facto control but to be different from each of them, created confusion among tax practitioners and the business community alike. As the Court held, the FCA’s “actual control” standard in fact “exacerbate[d] the problem” with the unclear 'effective control’ test employed by the TCC. The Court’s rejection of that articulation of the legislative rationale of the corporate loss restriction regime is both appropriate and welcome. Canadian taxpayers finally gain some certainty around what the law is, and it is not the amorphous ‘actual control’ test as the FCA expressed it.

Second (and most importantly), the Court unequivocally accepts the de jure control test found in the text of the Act as being the relevant benchmark Parliament established for when the legislative rationale of these rules should be engaged:14

[128] As I explained, the de jure control test was used as a means to implement Parliament’s aims in s. 111(5) because it appropriately recognizes that obtaining majority voting shares carries with it the ability to elect the board of directors and therefore to control the management of the affairs of the corporation (Buckerfield’s, at pp. 302-3; Duha Printers, at paras. 35-36). Matco achieved the functional equivalent of such an acquisition of control through the Investment Agreement, while circumventing s. 111(5), because it used separate transactions to dismember the rights and benefits that would normally flow from being a controlling shareholder. Several aspects of the transactions at issue demonstrate this functional equivalence, by which I mean that Matco achieved an outcome that Parliament sought to prevent without directly acquiring the rights that would have triggered s. 111(5) (Trustco, at para. 57; Copthorne, at para. 69). [Emphasis added.]

This determination constitutes the hinge on which the balance of the Judgment swings. Neither the FCA nor the Crown accepted the de jure control standard as inherent in the OSP of the corporate loss restriction regime, and the Supreme Court (both in the Judgment and dissenting reasons) resolved most of the interpretive uncertainty by rejecting the proposed standard of a test reliant on some lower or lesser degree of control over a corporation. Instead, DKIC v. Canada endorsed the de jure control standard as the cornerstone of the relevant legislative rationale, using as its threshold that degree of control obtained when one has the ability to direct a majority of the voting rights of a corporation’s shares and thereby legally bind and direct the affairs of the corporation or its “functional equivalent”. Essentially, the Court’s legal conclusion can be paraphrased as, the legislative rationale of these rules is contravened when an unrelated person or group of persons acquires a degree of control over a corporation that is the “functional equivalent” of de jure control, even if not meeting the legal definition of (or in the majority’s view, using means or factors not applicable to) that concept. This is a reasonable conclusion, even accepting that a fair degree of elasticity and disagreement might exist as to what constitutes the “functional equivalent” of the outcome Parliament sought to target with these rules. This conclusion also has the merits of clarity and certainty from a conceptual perspective as it largely adheres to and respects the text and context of the relevant provisions that consistently use the de jure control standard – certainly relative to arguments for some lower indeterminate standard of control.

Justice Rowe extensively reviewed the legislative history of the corporate loss restriction rules, to establish their purpose (in his language, the “why” rather than the “how”). His formulation of the legislative rationale is rather broad as a result and, respectfully, somewhat more so than is supported by a careful reading of the statute and relevant extrinsic materials:

[78] The first stage of the abuse analysis, ascertaining the object, spirit and purpose of the provisions, is an extricable question of law, subject to a correctness standard of review (see Alta Energy, at para. 50, citing Trustco, at para. 44; Housen v. Nikolaisen, 2002 SCC 33, [2002] 2 S.C.R. 235, at para. 8). To assess the underlying rationale of s. 111(5), it is necessary to consider the provision’s text, context and purpose (Copthorne, at para. 70). A review of the provision’s text, context and purpose reveals that Parliament intended to deny unused losses to unrelated third parties who take control of a corporation and change its business. I would formulate the object, spirit and purpose of s. 111(5) as follows: to prevent corporations from being acquired by unrelated parties in order to deduct their unused losses against income from another business for the benefit of new shareholders.

. . .

[113] In light of the foregoing, the object, spirit and purpose of s. 111(5) is to prevent corporations from being acquired by unrelated parties in order to deduct their unused losses against income from another business for the benefit of new shareholders. Parliament sought to ensure that a lack of continuity in a corporation’s identity was accompanied by a corresponding break in its ability to carry over non-capital losses. This is the rationale underlying the provision and properly explains why Parliament enacted s. 111(5). [Emphasis added]

Justice Rowe’s use of the term “acquired” in his formulation of OSP is somewhat vague and open-ended (as Justice Côté observes) and carries quite a bit of water. Ultimately however, Justice Rowe applied that legislative rationale in a limited and practical way: essentially these rules should apply when an unrelated person acquires the “functional equivalent” of de jure control, even via different means (e.g., contractual agreements not relating to share voting) than are applicable under the de jure control test set out in s. 111(5).

It is hard to overstate the importance of the Court’s tethering of the threshold for when the legislative rationale of the corporate loss restriction regime is engaged (i.e., a degree of control that is “functionally equivalent” to that attained by having de jure control) to the de jure control test itself that is used in the normal operation of these rules. In so doing, the Court refused the Crown’s invitation to apply a lower standard of control than the one Parliament established for these rules15 (or indeed something unrelated to control altogether), while ruling that achieving a “functionally equivalent” outcome through different methods frustrated Parliament’s intent. The business community should take considerable comfort from the Court relying on the de jure control test that applies in the corporate loss restriction rules as the de jure control threshold for their legislative rationale. This restriction of the practical scope of OSP to the limits of what is plainly evident in the non-GAAR operation of the relevant provisions is perhaps the legal principle of greatest precedential value arising from DKIC v. Canada.

Justice Côté’s dissent

Justice Côté ’s formulation of the OSP of s. 111(5) and surrounding provisions is significantly narrower:

[175] In sum, a change in control is the singular event that triggers the loss trading restrictions found in s. 111(5). The notion of “control” is therefore central to the operation of s. 111(5), and any object, spirit and purpose that omits it lacks coherence. In my opinion, the object, spirit and purpose of s. 111(5) is to deny the use of specified losses of a corporation if a person or group of persons has acquired de jure control of that corporation.

Justice Côté highlighted her concern with the potential breadth of the “functional equivalence” concept,16 and did not appear to accept “functional equivalence” of a de jure acquisition of control as part of the OSP of s. 111(5). The differences between the Judgment and the dissenting reasons are essentially three-fold:

- the majority articulates the threshold for when the legislative rationale of the corporate loss restriction rules is engaged as the “functional equivalent” of a de jure acquisition of control, while Justice Côté articulates that line as a de jure acquisition of control itself;17

- in formulating and applying the relevant threshold for the legislative rationale of the corporate loss restriction rules (as opposed to the strict application of the de jure control test itself), the Court held that it was permissible to consider factors and methods beyond those relating to share-voting ownership (i.e., commercial contracts such as the Investment Agreement) and the de jure control test did not fully capture Parliament’s intent18, while Justice Côté would not have; and

- on the facts, the majority found that Matco achieved the “functional equivalent” of de jure control, while Justice Côté found that it had not and, in fact, could not given the substantive legal differences between share voting rights and commercial contracts such as the Investment Agreement.

Justice Côté opined that when considering Parliament’s intent in enacting these rules to operate through the bright line test of de jure control, courts should be limited to considering not only the same level or degree of control that de jure control provides but also the same factors and methods (i.e., those in respect of share voting rights) that the statutory de jure test uses, to truly respect Parliament’s intent. Justice Côté ’s conclusion was that whatever control Matco did achieve was through factors (i.e., contractual rights such as the Investment Agreement) that aren’t part of a de jure control analysis (i.e. voting rights attached to share ownership). As such, the transactions at issue could not be found to have misused or abused these rules.

Justice Côté’s reasoning in dissent on the legal question of what factors are permissible and relevant in determining the OSP of the corporate loss restriction rules, and the degree of control required to trigger the OPS of the rules, closely reflect the position advanced by the Appellant. Justice Côté applied a strict and textual interpretation to both these rules and to GAAR, disagreeing with the “ad hoc approach” taken by the majority. First, Justice Côté opined that the preponderance of evidence on the text and context of the corporate loss restriction rules indicates that it is most likely Parliament intended to limit a corporation’s ability to use its own losses where there has been an acquisition of de jure control, as determined based on share voting rights. While not specifically cited by Justice Côté, examples of evidence consistent with such reasoning could include19 the consistent exclusion of concepts other than share voting rights within the text of the relevant provisions,20 the absence of any mention of such non-share-vote factors in any of the relevant extrinsic aids, the ease with which the government could have expressed its intention to capture such non-share-vote factors within the OSP of these rules had it chosen to do so (for example in the Technical Notes or by simply adopting the de facto control test), the subsequent amendment to add s. 256.1, previous CRA advance tax rulings issued on loss monetizations, and the fact that this type of planning was foreseeable to Parliament when it enacted these rules.

More importantly, as Justice Côté notes, the substantive legal differences between the ability to do the things that control a majority of a corporation’s voting rights brings and mere contractual agreements are profound and real:

[178] This novel concept treats the Investment Agreement as a constating document for the purposes of control (para. 122). The nuance lost on my colleague is that constating documents and external agreements are enforced in radically different ways. That being so, an ordinary contract can never be functionally equivalent to a constating document.

The relevance of this distinction can be illustrated by a simple example: if a better offer than the Matco arrangement had come along, would DKIC have been able to take it? If Matco had the ability to direct DKIC’s decision making via the ability to direct the voting of a majority of its shares and thereby control (or exercise) the actions of its directors, the existence of a better offer is irrelevant, no matter how much “better”: Matco could simply ignore it and cause the taxpayer to proceed with the existing arrangement. As Matco merely had ordinary commercial contract rights, its remedy would be limited to invoking the civil courts and requiring some form of positive direction from the judicial system preventing the taxpayer from completing the alternative transaction and completing the existing one, a dramatically inferior level of recourse likely to leave Matco with a court date many months after the alternative transaction had closed.

In any event, the difference between the Judgment and Justice Côté’s dissent (along with the TCC) as to the taxpayer’s freedom of action under the Matco Investment Agreement is ultimately one that is limited to the facts of this case, and so of little precedential value. The legal difference between the two approaches to determining the OSP of the corporate loss restriction rules (i.e., whether courts are permitted to consider whether an unrelated party had acquired the “functional equivalent” of de jure control in determining whether the corporate loss rules have been abused or misused) is one that reasonable people can differ on, and of secondary importance to the far more important point of agreement: the relevant standard of control within the legislative rationale of the corporate loss restriction rules is indeed de jure control, and not some lesser standard.

The Court’s adoption of “functional equivalence” as part of determining OSP is an interesting feature of the Judgment and is in keeping with the trajectory of the jurisprudence on interpreting and applying GAAR. Even prior to this case, many tax advisors would consider a taxpayer who has achieved the “functional equivalent” of a result (acquiring de jure control in this case) that Parliament has created rules clearly directed at to be at serious risk of crossing the threshold of the tax policy of those rules, so as to engage them via GAAR. Protestations as to the importance of how such “functional equivalence” was achieved (i.e., in this case, factors and methods other than those in respect of share voting rights, such as the Investment Agreement) are both substantive and legitimate (as Justice Côté observed), and the taxpayer in DKIC v. Canada had a strong argument that no such “functional equivalence” of de jure control was in fact acquired (again, as Justice Côté opined). However, this case illustrates the practical reality that once the taxpayer is labelled (rightfully or wrongfully) as having achieved a result that is “functionally equivalent” to that which the relevant legislative regime is directed, she has an uphill struggle to convince a court why GAAR ought not to apply. The fundamental lesson is, where a taxpayer achieves a result that is close to or similar to what a provision of the Act targets (i.e., acquiring de jure control in this case):

- it is critically important to be able to clearly articulate why that result is not the “functional equivalent” of the outcome targeted by that provision; and

- if it is found to be “functionally equivalent”, she may be (but should not count on being) able to convince the CRA or ultimately a court that something about the way in which this result was achieved was meaningful enough to fall outside of the legislative rationale of that provision.

Increased discretion in the misuse or abuse analysis

It is noteworthy that Justice Rowe spends quite a bit of time on “purpose” (or in his parlance, “the why”) in determining that factors other than those relating to share voting should be included in the legislative rationale of a provision using a de jure control test. Respectfully, the elevation of purpose over text and context in this regard reflects a potentially result-oriented form of reasoning and increases the discretionary element of the misuse or abuse analysis since statements of purpose are inherently general and arguably, discretionary, in nature.

Broad statements of purpose (e.g., Budget speeches) are dangerous to use as evidence of legislative rationale, since they are typically high level and often do not capture the deliberate nuances of tax policy reflected in the statute.21 The fact that the Court felt it necessary to have recourse to extrinsic materials from the 1950s and 1960s on earlier versions of the corporate loss restriction rules (which, it must be observed, employed very different thresholds for application) to establish a basis for its formulation of OSP is remarkable. It will be interesting to see if courts are similarly willing to use broad statements of purpose when considering the legislative rationale of favourable, benefit-conferring provisions, as they are in determining the legislative rationale of unfavourable, restrictive provisions such as the corporate loss restriction regime in s. 111(5).

The primary practical takeaway from the Judgment is that, if a court perceives the taxpayer to have achieved an outcome contrary to the general aims of the relevant provisions, the taxpayer should not count on being saved by virtue of subtle policy nuances, or planning that approaches but does not quite cross the line of the technical provisions themselves. Rather, taxpayers can expect to see the CRA applying the “functionally equivalent” label in GAAR cases going forward.

It is this interpretative element of DKIC v. Canada that is of greatest concern to the business community. A robust GAAR that protects the tax base is essential to the tax system, but for such a rule to be fair to the tax system as a whole it must not be over-broad and should strive for the very objective that the government expressed when GAAR was enacted in 1988: “’reasonably predictable result[s]’ so that taxpayers can comply with the rule, and the administration and the courts can easily apply it.”22 Reasonable people can disagree as to the correct outcome of DKIC v. Canada. Going forward taxpayers can expect the CRA to advance the “functionally equivalent” test to justify applying GAAR to close-to-the-line situations (particularly where “sophisticated” tax planning has been undertaken).23 To that extent, the Judgment arguably supports the application of GAAR on a discretionary basis, without the rigour and process advocated for by the Chamber in the SCC.

Impact on the need for legislative amendments

Importantly, DKIC v. Canada dramatically undercuts the government’s stated justification for proposing legislative amendments to the GAAR aimed at making it easier for the government to apply. In August 2022, the Department of Finance issued a discussion paper (the Discussion Paper)24 on possible legislative amendments to s. 245. The Discussion Paper described the purpose of the exercise as follows:

This paper follows through on the 2020 Fall Economic Statement commitment to improve tax fairness by consulting with Canadians on approaches with Canadians on approaches to strengthening the General Anti-Avoidance Rule (GAAR) in the Income Tax Act (the Act).

. . .

A large body of case law has developed, which has helped assuage the concerns expressed at the time of the GAAR's introduction that it would introduce too much uncertainty into the Canadian tax system. Nevertheless, a number of decisions and other developments have pointed to some issues with the GAAR that should be addressed so that it better meets its objective of preventing abusive tax avoidance.

. . .

This consultation represents a targeted and practical diagnostic on the GAAR, having regard to the decided case law, commentary made by academics and tax practitioners, the experiences of the Canada Revenue Agency (CRA) and Department of Justice (Justice) in dealing with taxpayers (and their advisers) and the courts, and the perspectives of the Department of Finance on constraining abusive tax avoidance.

Rather than waiting for the Supreme Court’s decision in DKIC v. Canada, the government chose to move ahead in the March 28, 2023 federal budget (the March 2023 Budget) by releasing specific proposals to amend GAAR (the March 2023 Proposals),25 which the March 2023 Budget explained as follows:

The general anti-avoidance rule (GAAR) in the Income Tax Act is intended to prevent abusive tax avoidance transactions while not interfering with legitimate commercial and family transactions. If abusive tax avoidance is established, the GAAR applies to deny the tax benefit created by the abusive transaction.

A consultation on various approaches to modernizing and strengthening the GAAR has recently been conducted. A consultation paper released last August identified a number of issues with the GAAR and set out potential ways to address them. As part of the consultation, the government received a number of submissions, representing a wide variety of viewpoints.

To respond to the issues raised in the paper taking into account stakeholder feedback, Budget 2023 proposes to amend the GAAR by: introducing a preamble; changing the avoidance transaction standard; introducing an economic substance rule; introducing a penalty; and extending the reassessment period in certain circumstances.

The March 2023 Budget makes clear that, following the receipt of comments on its proposed amendments (due by May 31, 2023), it will proceed to act: no further consultations will be undertaken.26

The Canadian Chamber of Commerce filed submissions on both the Discussion Paper27 and the March 2023 Proposals. Its submission on the March 2023 Proposals28 (the May 2023 Submission)29 reviews the GAAR jurisprudence in detail (along with the extrinsic materials issued by the government when GAAR was enacted in 1988), for the purpose of testing the government’s apparent premise that the jurisprudence was not adequately addressing the concerns identified by the government in legislating the GAAR. Its conclusion was that the GAAR jurisprudence was indeed already on all fours with the very issues raised by the government in the March 2023 Proposals, leading to the question: what then is the government hoping to achieve with the March 2023 Proposals, and are they intended to change the law as established in the existing GAAR jurisprudence or merely codify it? Without some expression from the government on this point, the danger of proceeding to make legislative amendments is to undermine the efficacy of years of guidance from the courts provided by the existing GAAR caselaw. Such would be an extremely unfortunate result which, the Supreme Court has now made clear, is completely unnecessary.

In the March 2023 Budget, the government explained its perceived need for the interpretative pre-amble proposed to be added as new s. 245(0.1) as follows:

A preamble would be added to the GAAR, in order to help address interpretive issues and ensure that the GAAR applies as intended. It would address three areas where questions have arisen.

While the GAAR informs the interpretation of, and applies to, every other provision of the Income Tax Act, it fundamentally denies tax benefits sought to be obtained through abusive tax avoidance transactions. It in effect draws a line: while taxpayers are free to arrange their affairs so as to obtain tax benefits intended by Parliament, they cannot misuse or abuse the tax rules to obtain unintended benefits.

As noted in the original explanatory notes accompanying the GAAR, it is intended to strike a balance between taxpayers' need for certainty in planning their affairs and the government's responsibility to protect the tax base and the fairness of the tax system. "Fairness" in this sense is used broadly, reflecting the unfair distributional effects of tax avoidance as it shifts the tax burden from those willing and able to avoid taxes to those who are not.

Finally, the preamble would also clarify that the GAAR is intended to apply regardless of whether or not the tax planning strategy used to obtain the tax benefit was foreseen.

Existing GAAR jurisprudence already incorporates all three of these principles. DKIC v. Canada demonstrates this quite clearly. With respect to the general role of GAAR, the Supreme Court in DKIC v. Canada held as follows:

[47] The Duke of Westminster principle, however, has “never been absolute” (Lipson, at para. 21) and it is open to Parliament to derogate from it. Parliament has done so through the GAAR. The GAAR does not displace the Duke of Westminster principle for legitimate tax planning. Rather, it recognizes a difference between legitimate tax planning — which represents the vast majority of transactions and remains unaffected, consistent with the Duke of Westminster principle — and tax planning that operates to abuse the rules of the tax system — in which case the integrity of the tax system is preserved by denying the tax benefit, notwithstanding the transactions’ compliance with the provisions relied upon. Even where the purpose of a transaction is to minimize tax, taxpayers are allowed to carry it out unless it results in an abuse of the provisions of the Act (Lipson, at para. 25). Where the transaction is shown to be abusive, the Duke of Westminster principle is “attenuated” by the GAAR (Trustco, at para. 13).

Similarly, the Supreme Court plainly acknowledged GAAR’s balancing of protecting the tax base with taxpayers’ desire for a reasonable degree of certainty in arranging their affairs:

[48] In establishing a general anti-avoidance rule that operated to deny tax benefits on a case-specific basis, Parliament was cognizant of the GAAR’s implications for the level of certainty in tax planning. Parliament sought to balance “the protection of the tax base and the need for certainty for taxpayers” (Department of Finance, Explanatory Notes to Legislation Relating to Income Tax (1988), at p. 461). The GAAR was enacted to be “a provision of last resort” to address abusive tax avoidance only and was therefore not designed to create more generalized uncertainty in tax planning (Trustco, at para. 21; Copthorne, at para. 66). Some uncertainty is unavoidable when a general rule is adopted (Dodge, at p. 21; Copthorne, at para. 123). However, a reasonable degree of certainty is achieved by the balance struck within the GAAR itself.

. . .

[50] . . . Within this analysis, the principles of certainty, predictability and fairness do not play an independent role; rather, they are reflected in the carefully calibrated test that Parliament crafted in s. 245 of the Act and in its interpretation by this Court.

Finally, the Supreme Court acknowledged that GAAR can apply to tax planning that is both foreseen and unforeseen:

[45] . . . Abusive tax avoidance can involve unforeseen tax strategies (Canada v. Alta Energy Luxembourg S.A.R.L., 2021 SCC 49, at para. 80). For example, in Alta Energy, this Court treated evidence of Parliament’s knowledge and acceptance of the tax strategy at issue as a relevant consideration when ascertaining its intent. However, the GAAR is not limited to unforeseen situations; as this Court has explained, it is designed to capture situations that undermine the integrity of the tax system by frustrating the object, spirit and purpose of the provisions relied on by the taxpayer (Lipson v. Canada, 2009 SCC 1, [2009] 1 S.C.R. 3, at para. 2; Copthorne Holdings Ltd. v. Canada, 2011 SCC 63, [2011] 3 S.C.R. 721, at paras. 71-72; see also The Gladwin Realty Corporation v. The Queen, 2020 FCA 142, [2020] 6 C.T.C. 185, at para. 85; D. G. Duff, “General Anti-Avoidance Rules Revisited: Reflections on Tim Edgar’s ‘Building a Better GAAR’” (2020), 68 Can. Tax J. 579, at p. 591).

Similarly as regards the government’s complaint in the Discussion Paper that “[t]he GAAR does not sufficiently take into consideration the economic substance of transactions,” a careful review of the GAAR jurisprudence provides extensive evidence of the application and consideration of the economic substance of transactions (whether or not using that specific term) in both determining the relevant legislative rationale and testing the taxpayer’s actions against it when undertaking an abuse or misuse analysis. Once again, the Supreme Court’s decision in DKIC v. Canada supports that conclusion. In searching for Parliament’s legislative rationale for the corporate loss restriction rules, Justice Rowe quoted extensively from comments made by the then-Minister of Finance in 1963, including the following (at para. 107):

People with profitable businesses who were paying taxes on their profits were making a practice of acquiring companies, often shells which had nothing in them but which were in possession of a loss-carry-forward entitlement, for the purpose of applying this entitlement against their profits and thus avoiding the payment of tax. That is what this clause is intended to prevent. I am prepared to admit that in theory, certainly, if you look upon the corporation which has the entitlement as being a separate entity, it does lose its rights, where its ownership has been transferred to somebody else. However, that is the very thing we are trying to stop. [Emphasis added by Justice Rowe.]

(House of Commons Debates, vol. V, 1st Sess., 26th Parl., November 1, 1963, at p. 4287 (Hon. Walter L. Gordon))

See further at para. 110:

When a corporation changes hands, and the loss business ceases to operate, the corporation is effectively a new taxpayer who cannot avail itself of non-capital losses accumulated by the old taxpayer. The following provides a useful explanation:

First and foremost, the carryover of losses following a change of control is not generally supported in tax policy terms. Normally, one taxpayer cannot avail himself of another taxpayer’s losses. In the case of an artificial entity such as a corporation, when its control changes it is essentially regarded as a new taxpayer, because different shareholders then become entitled indirectly to enjoy the benefits of its financial success. [Emphasis added by Justice Rowe.]

(Strain, Dodge and Peters, at p. 4:52)

Similarly, when considering whether the taxpayer’s actions contravened the legislative rationale of the corporate loss utilization regime, Justice Rowe demonstrably found it appropriate and indeed necessary to have recourse to considerations of economic substance:

[124] Section 111(5)’s rationale is to prevent corporations from being acquired by unrelated parties in order to deduct their unused losses against income from another business for the benefit of new shareholders. As previously explained, s. 111(5) reflects the proposition that when the identity of the taxpayer has effectively changed, the continuity at the heart of the loss carryover rule in s. 111(1)(a) no longer exists. From this perspective, the same result was achieved through the impugned transactions. Indeed, the reorganization transactions resulted in the appellant’s near-total transformation: its assets and liabilities were shifted to Newco, such that all that remained were its Tax Attributes. Put differently, the appellant was gutted of any vestiges from its prior corporate “life” and became an empty vessel with Tax Attributes.

. . .

[127] As for its business activity, the appellant was used as the vessel for an unrelated venture planned by DKCM and selected by Matco. Thus, the only link between the appellant after the transactions and its prior corporate “life” was the Tax Attributes; in other respects, it was, in practice, a company with new assets and liabilities, new shareholders and a new business. Accordingly, the transactions resulted in a fundamental change in the identity of the taxpayer. The appellant’s continued ability to benefit from the loss carryover deductions frustrates the rationale behind Parliament’s decision to sever the continuity of tax treatment in s. 111(5), particularly considering the rights and benefits obtained by Matco.

. . .

[133] Third, the transactions allowed Matco to reap significant financial benefits. Through the transactions at issue, Matco became a significant equity owner and maintained a stake in the corporation worth $4.5 million following the IPO.

. . .

[140] Considering the foregoing circumstances as a whole, the result obtained by the transactions clearly frustrated the rationale of s. 111(5) and therefore constituted abuse. The object, spirit and purpose of s. 111(5) is to prevent corporations from being acquired by unrelated parties in order to deduct their unused losses against income from another business for the benefit of new shareholders. The transactions achieved the very result s. 111(5) seeks to prevent. Without triggering an “acquisition of control”, Matco gained the power of a majority voting shareholder and fundamentally changed the appellant’s assets, liabilities, shareholders and business. This severed the continuity that is at the heart of the object, spirit and purpose of s. 111(5).

To the extent there was any justification for the legislative amendments to GAAR contained in the March 2023 Proposals, the Supreme Court’s decision in DKIC v. Canada negates it. The existing GAAR jurisprudence is already performing the very functions that the March 2023 Proposals relating to abuse and misuse purport to address. The government should reconsider and withdraw these elements of the March 2023 Proposals, or (if not) clearly explain how they deviate (if at all) from the existing GAAR jurisprudence, viz., are they intended to change the current state of the law (post-DKIC v. Canada), and if so how.

In fact, the Supreme Court had the opportunity to address or otherwise endorse the Discussion Paper,30 or to even put out a call to Parliament for reform as it has done in the past.31 It is notable that the Supreme Court did not do so and instead endorsed the existing legislation and case law as being quite sufficient and eminently capable of continued interpretation and application. The government should not ignore this signal from the Supreme Court. Rather, it should pause, digest DKIC v. Canada and, in our submission, narrow the focus of any future GAAR reform or rethink it all together.

With reference to the suggestion in the March 2023 Proposals to include a GAAR-specific penalty, again, this case illustrates the deficiency in this proposal. This case was ultimately one of legitimate interpretive uncertainty (what was the OSP of the corporate loss restrictions and did the de jure control test fully capture this OSP?) and differences of opinion over rights available to the taxpayer on the facts. It is difficult to see why a penalty should apply to GAAR which is based in an inherent understanding that a strict application of the Act is not always enough to capture Parliament’s intent and that only judicial consideration of the transaction and the relevant provisions will confirm for the taxpayer and the CRA the correct application of the relevant provision. Here, a total of 12 judges considered the transaction, and split 10-2 on the result. Penalizing a taxpayer in such circumstances where even the judges who considered the case were divided in their views is patently unfair and is not the purpose of penalties. DKIC v. Canada constitutes a further example of why a blanket penalty whenever GAAR is found to be applicable is not justifiable from a policy perspective and was previously rejected when considered in 1988.

Where we go from here

In the Discussion Paper, the government identified the options open to it for more clearly articulating the legislative rationale of the provisions it enacts. The government further stated that it was “also interested in hearing about other issues with the GAAR that people believe have lead to inappropriate outcomes.” The March 2023 Proposals did not include any content addressing either of these issues.

As to the former, the May 2023 Submission stated as follows:

In any event, the choice between certainty and protection of the tax base (whether or not labelled as “fairness”) is ultimately a false one. It is not necessarily the case that one can only be achieved at the expense of the other. It is almost entirely within the government’s power to provide more certainty by better articulating legislative rationale as the Discussion Paper itself proposes, without diminishing GAAR’s effectiveness in preventing abusive tax behaviour. Certainty need not be sacrificed in pursuit of other objectives and is in fact enhanced along with fairness if it is achieved by better articulating legislative rationale.

Rather than creating more uncertainty by instilling doubt over the continued efficacy of the existing GAAR caselaw, the government is uniquely placed to reduce it (and achieve its own aims of winning a greater proportion of the GAAR cases it litigates) by announcing what it proposes to do to follow through on the suggestions it made in the Discussion Paper for better articulating Parliament’s legislative rationale. Whatever residual deficiency in the GAAR jurisprudence might possibly have existed before DKIC v. Canada, there is simply nothing left for the government to “fix”. As the May 2023 Submission states:

Since the clarity of a particular legislative rationale is almost exclusively in the government’s hands to articulate (for the benefit of all concerned), the government can win a higher proportion of its GAAR cases by expending more effort to set out the legislative rationale. While doing so is not a costless exercise, the government is the party by far best-placed to do this and to bear the cost, and when compared against the government’s cost of auditing, re-assessing and litigating GAAR cases, the overall impact of better expressing its OSP must certainly be a net cost savings to the government alone, quite apart from the vast savings that would be enjoyed by taxpayers. Tax advisors and litigators would be the only disadvantaged parties. There is nothing a government interested in preserving the “fairness” of the tax system could do that would have a greater and more beneficial impact than this.

In urging greater effort to express legislative rationale, the business community should not be understood to be seeking perfection or “certainty.” However, there are clearly areas of recurring GAAR controversies such as surplus stripping and loss utilization that can be targeted first, as priority areas where the government can achieve greater clarity and have immediate impact without being asked to prepare a user’s guide for the entire statute.

Fundamentally, DKIC v. Canada can be reduced down to a case with a modest (although important) high-level conceptual legal issue that could have been forestalled with a single sentence in the Technical Notes that accompanied the legislation enacting GAAR: ‘While s. 111(5) applies where an acquisition of de jure control occurs, the tax policy underlying these rules is applicable whenever an unrelated person (or group of persons) acquires a “functionally equivalent” degree of control over the corporation (whether through share voting rights or otherwise)’.

As to the government’s invitation to bring forward “other issues with the GAAR that people believe have lead to inappropriate outcomes”, it will be interesting to see if any response is received to the suggestions made in the May 2023 Submission for reforming and improving the administration of GAAR to prevent administrative over-reach and define the government’s articulation of legislative rationale as early as possible in the case, so as to reduce the volume and cost of GAAR litigation. DKIC v. Canada highlights the need to require the Crown early on in the process (ideally at the GAAR Committee stage) to clearly articulate where it believes the line is – had that been done in this case, the litigation would almost certainly have been completed much faster and at less expense. If the Crown cannot or will not articulate with a reasonable degree of specificity where it believes the threshold is within the OSP of the relevant provisions for engaging them or avoiding their application as a tax policy matter, this should properly be viewed as indicating an OSP that has not adequately been evidenced and/or a weak case that requires further review and refinement before proceeding.