On Feb. 22, 2024, Finance Minister Katrine Conroy tabled British Columbia’s budget for 2024, titled “Taking Action for You” (Budget 2024).

What you need to know

- There are changes to the Employer Health Tax (EHT), cast as giving small to medium sized businesses a break.

- As of 2025, there will be a new residential property “flipping tax” to discourage speculation.

- B.C. is expanding the production, machinery and equipment (PM&E) exemption for renewable energy production projects, and removing oil and gas tax credits.

The Employer Health Tax exemption

The Employer Health Tax exemption threshold is increased from $500,000 to $1,000,000. For small and growing businesses, this means a reprieve from the EHT so long as their total annual payroll is less than $1,000,000. B.C. estimates that 90 per cent of businesses will now be exempt from the tax, and those that have payroll between $1,000,000 and $1,500,000 will remain partially exempt.

New residential “flipping tax”

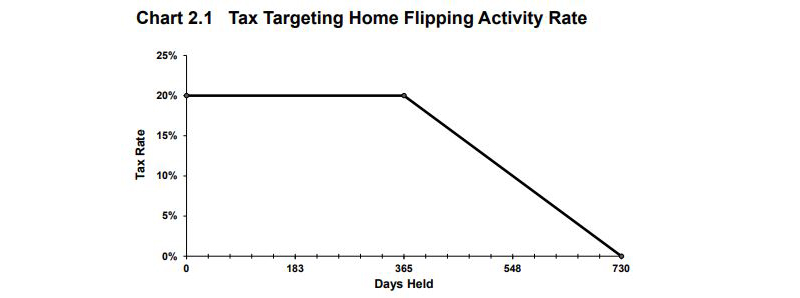

There is a new residential “flipping tax”, with draft legislation forthcoming in Spring 2024. To “prioritize homes as living spaces”, Budget 2024 announces that effective Jan. 1, 2025, new “flipping” tax legislation will target short-term speculation activity with a sliding scale approach. The tax will apply on the sale of any residential property sold within two years of purchase at a rate of 20 per cent (with exemptions for sales motivated by certain life events such as death, divorce, or relocation for work). The sale of a primary residence is not exempt, but a maximum of $20,000 can be excluded when calculating the individual’s taxable income.

As an expansion on the property “flipping” changes implemented by the Federal 2022 Budget, the new B.C. residential “flipping” tax is designed to cool the Vancouver housing market and further deter speculators (if the province’s Speculation and Vacancy Tax and the municipal Empty Homes Tax were not high enough barriers).

Budget 2024: Taking Action for You - Budget and Fiscal Plan 2024/25 – 2026/27, February 22, 2024 (p.66)

The PM&E exemption and oil and gas tax credits

Effective Feb. 23, 2024, the Provincial Sales Tax Exemption and Refund Regulations are amended to clarify that projects that use sunlight, wind, tides, air, or water to manufacture energy now qualify for the PM&E exemption. The expansion of the exemption to “green” energy projects emphasizes B.C.’s focus on clean energy and aligns with the CleanBC Plan and other initiatives like the Innovative Clean Energy Fund.

At the same time, Budget 2024 announced that also effective Feb. 23, 2024, oil and gas exploration expenditures will no longer qualify for the mining exploration tax credit (METC). After extensive consultation with the Mining Jobs Task Force, on Jan. 28, 2019, then Premier John Horgan announced that the METC was made “permanent, something the previous government would not do.”1 The current Premier, David Eby, has walked back that promise of permanence for the oil and gas side of the METC. With green energy being such a focus for the province, it is possible future amendments to B.C. legislation would also revoke the METC for other industries viewed as polluters, such as coal.

“Software” in the Provincial Sales Tax Act

Effective April 1, 2013, Budget 2024 proposes to amend and clarify the definition of “software” in the Provincial Sales Tax Act. The retroactive nature of the amendment will mean that any cloud-based computing products or services where payment is made to access online software products “on-demand” will be viewed as taxable beginning April 1, 2013. It won’t be clear until the draft amendment to the Provincial Sales Tax Act is released, but the change may go as far as deeming ordering products via and online platform or online technical support services to be “software”.

This amendment is likely a response to the recent case Hootsuite Inc. v British Columbia (Finance)2, where the British Columbia Supreme Court (BCSC) allowed the taxpayer’s appeal in full. The BCSC held that PST did not apply to certain cloud computing services due to the definition of “software”. For more information on the Hootsuite decision, please see our previous publication from our indirect tax team.

Although the previous definition of “software” included software programs, not all software constituted a software program. The amendment proposed by Budget 2024 will clarify the definition, retroactively revising “software” to include cloud computing services like those in Hootsuite.

Other commodity related Budget 2024 items include:

- The reduction of availability of PST refunds where a person acts as though they are the end purchaser but are actually acquiring the goods for export and resale outside B.C.

- Enabling PST refunds to a person who purchases goods from a seller who did not collect PST where the purchaser self-assesses PST (but then returns the goods for a refund).

- Amendments to the definition of “registered occupier” in the Speculation and Vacancy Tax Act, making the registered leaseholder liable for the tax as opposed to the owner of a leasehold property.

- Amendments to the Property Transfer Tax Act increasing various threshold values (such as the first-time home buyers exemption from $500,00 to $835,000).

Takeaways

The indirect tax changes as proposed by Budget 2024 will impact both businesses and individuals. B.C. Finance continues to champion green energy and disincentivize traditional oil and gas producers, making it less and less appealing to be an oil and gas producer in the province.

The digital services space in B.C. is also evolving – with B.C. taking retroactive measures to counter the BCSC decision in Hootsuite. The definition of "software” and “software as a service” is being expanded, and any business that operates online or provides online technical support should take notice.

Taxpayers should stay on alert this Spring and early summer as crucial draft legislation is released on the proposed “flipping tax”, as well as the amendment to the definition of “software”.

For more information on Budget 2024 for British Columbia and how the indirect tax changes may impact you, please reach out to a member of our team including any of the key contacts listed below.

1 Government acts on mining jobs task force recommendations, News Release January 28, 2019, B.C. Premier’s Office.

2 Hootsuite Inc. British Columbia (Finance), 2023 BCSC 358.