Introduction

The Government of Canada has recently released its 2023 budget entitled “A Made-in-Canada Plan: Strong Middle Class, Affordable Economy, Healthy Future” (2023 Budget). The 2023 Budget represents a major commitment towards net-zero climate goals and Canada’s energy transition. The release of the 2023 Budget also coincides with one year anniversary of the federal government’s emissions reduction plan under the Canadian Net-Zero Emissions Accountability Act (as discussed in our December 2022 article) and arrives at a time of renewed commitments with the U.S. on climate matters.

With the release of the 2023 Budget, reviewed by BLG in our article “A masterclass in increasing taxes without increasing rates,” Canada revealed its first substantive response to the eye-catching U.S. Inflation Reduction Act (IRA) passed by the Biden administration in August 2022.1 Concerns over the impact of the IRA began to manifest almost immediately after its passage, as the ambitious U.S. initiative could dampen Canadian based innovation and capital investment. The 2023 Budget is designed to challenge the potential migration of climate capital southward while balancing national climate policies at home.

Key takeaways

- As anticipated, the 2023 Budget is a direct response to the IRA and includes incentives meant to address flight-risk of Canadian investment capital in alternative energies.

- The tax incentives in the 2023 Budget are designed to grow a number of industries and sectors in an alternative energy economy including critical minerals, hydrogen, nuclear and ZEV sectors.

- The tax incentives are geared towards funding the construction of alternative energy projects on Canadian soil rather than production-based targets or operational expenses.

- The 2023 Budget introduces contracts for difference alongside the Canada Growth Fund to encourage private sector investment. Consultations are pending with investments to occur later in 2023.

Background

The IRA was signed into law in the U.S. on August 16, 2022. Its stated aims are to: reduce the deficit, fight inflation, invest in U.S. based energy production and manufacturing and reduce carbon emissions by 40 per cent by 2030.

A central component of the IRA is its commitment to developing the U.S. energy sector, and specifically, implementing energy alternatives throughout the country. The IRA’s primary mechanism to promote energy alternatives is by earmarking approximately US$369 billion in tax incentives and increased spending over the next 10 years for renewable energy technologies such as wind and solar production, and carbon sequestration. Those funds are allocated by both extending and expanding existing tax credits and creating new ones.

The IRA is designed to promote the use of new and alternative energy sources at both the business level and the consumer level. It utilizes tax credits for both. At the business level, the IRA incentivizes investment in the development and production of alternative energy technologies through tax credits that effectively operate as subsidies. It also synergistically incentivizes consumers to purchase the alternate technologies by providing tax credits and other incentives to consumers to implement these technologies in their household to make them more energy efficient or to purchase goods that incorporate them, such as the purchase of electric vehicles, heat pumps and biomass stoves.

Overview of the 2023 Budget

Chapter 3 of the 2023 Budget is a direct response to the IRA. The 2023 Budget proposes to respond to the IRA by introducing or expanding on existing mechanisms to facilitate the transition to energy alternatives. The Federal Government has committed approximately $20 billion over five years to the energy transition which represents an equivalent investment considering Canada’s GDP is roughly one-tenth that of the U.S.

The majority of the incentives related to energy transition are investment tax credits. These tax credits focus on tackling climate change indirectly by incentivizing investments in sectors that will lead to reduced emissions.

Prior to the IRA, Canada’s focus was primarily on mitigating the effects of climate change with policy choices such as carbon pricing. Building on the federal benchmark and Output-Based Pricing System, 2023 Budget contains plans to develop contracts for difference through the Canada Growth Fund designed to address carbon pricing predictability in the long-run. Contracts for difference are contracts entered into between the federal government and industry proponents where the Federal government would agree to pay the proponent a certain price for hitting emissions targets. For example, a contract for difference may be used to create a more standardized price for carbon credits.

The aim of promoting contracts for difference is to promote certainty for pricing on carbon or hydrogen by providing a backstop for value on items like carbon credits. The development of predictable benefits for complying with carbon pricing would facilitate funding for major projects at the outset which is not as clearly accomplished through the refund-based tax incentives discussed below. If implemented, contracts for difference could potentially assist with larger capital investments by providing cost certainty on the monetary benefits received for meeting emission targets.

Income Tax Credits

Both the IRA and the 2023 Budget stimulate the commercialization of domestic green technologies by offering tax credits. One major difference, aside from the sheer aggregate amount of funding available (approximately US$216 billion for clean energy, transport and manufacturing) is the way that tax incentives can be claimed in each country.

Virtually all of the clean energy incentives available for business in the IRA allow for “direct pay” and transferability which enables local and state government groups to benefit from the tax incentives that would otherwise be unavailable.2 Energy related incentives are treated as direct payments of tax meaning that even where an entity has a tax liability less than the credit amount, the full amount can still be claimed or alternatively, transferred.

The IRA offers uncapped and unrestricted subsidies with no ceiling, meaning that incentives could range in payments of US$369 billion to $1.7 trillion depending on capital mobilization.3 By comparison, the 2023 Budget offers refundable tax credits that can be applied against tax owing by a particular entity, or alternatively, allows for a percentage credit against the capital cost of eligible equipment. In the case of nuclear manufacturing, similar to the 2021 budget announcement for zero-emission technology manufacturers, corporate income tax rates have been halved. In order to compete with the U.S.’s larger investment pool, the 2023 Budget opts to focus on construction of projects by offering incentives for building rather than meeting operational emissions goals and production targets.

There are a number of key tax credits associated with the 2023 Budget that are set to contribute to growth and economic development in the clean technology sector. These tax credits are largely designed to try and compete with the financial incentives found in the IRA, although they function differently. Notable tax credits addressed in the 2023 Budget (Credits) include:

- Clean Hydrogen Investment Tax Credit;

- Carbon Capture, Utilization, and Storage Investment Tax Credit;

- Clean Technology Manufacturing Tax Credit;

- Clean Electricity Investment Tax Credit; and

- Zero-Emission Technology Manufacturers income tax rate reduction.

These Credits are said to form part of “an integrated North American approach that benefits U.S. and Canadian workers, suppliers, and products.”4 It will be important for industry professionals to understand the differences between the various types of credits offered as only one of the Credits can be claimed for eligible property. We examine a number of these tax credits in further detail below.

a. Labour requirements

Similar to the IRA’s prevailing wages and apprenticeship requirements, the CH Tax Credit (CH Tax Credit) and Clean Technology Investment Tax Credit (CT-ITC, announced in the 2022 Federal Budget) are contingent in part based on meeting labour requirements applicable to manual or labour duties performed on behalf of by businesses, contractors and subcontractors. These requirements are expected to eventually apply to all Credits.

Labour requirements include both a prevailing wage and apprenticeship requirement and includes factors related to compensation, pension amounts, health and vacation benefits, and collective agreements. Apprenticeship criteria can be met where not less than 10 per cent of the total labour hours by covered workers is performed by registered apprentices. Lower tax credit rates are available where labour requirements are not met, typically with a 10 per cent difference in the value of the Credits.

b. Clean hydrogen investment tax credit

Critical to the federal hydrogen strategy for Canada, the CH Tax Credit is a refundable tax credit with eligibility tied to an assessed carbon intensity rate (CI, being kg CO2e per kg of hydrogen) based on the “cradle-to-gate” Fuel Life Cycle maintained by Environment and Climate Change Canada. The CH Tax Credit is only available to productions that have completed an “engineering design study” prior to coming online and will be available for hydrogen produced from either electrolysis or natural gas.

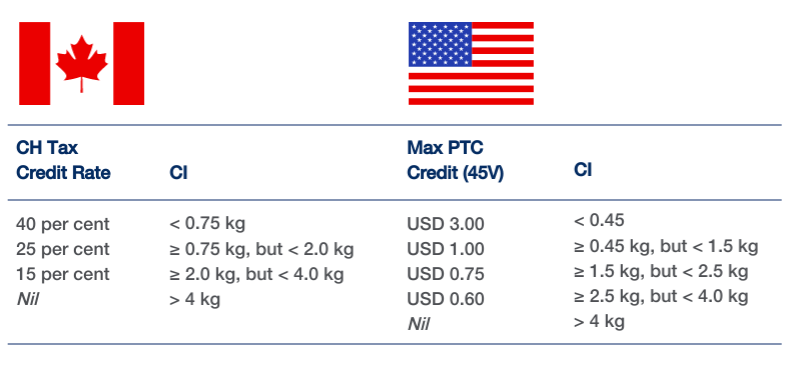

The carbon intensity rates and applicable tax credit rates as found under the 2023 Budget and the IRA are as follows:

Hydrogen projects that produce hydrogen from natural gas are only eligible for the CH Tax Credit, if CCUS is used to abate emissions.

The CH Tax Credit is still available for defined “eligible equipment” but cannot be applied against CCUS equipment that falls under the separate Investment Tax Credit for CCUS. Eligible equipment includes some CCUS, oxygen production equipment, heat/power producing equipment and dual use production equipment but does not include operating expenses, studies, and front-end engineering.

i. Clean ammonia

Budget 2023 also states that conditions for the CH Tax Credit to apply to clean ammonia, including eligible equipment, will be announced at a later date noting:

Property that is required to convert clean hydrogen (i.e., meets a CI of less than 4 kg of CO2e per kg of hydrogen) to clean ammonia would also be eligible for the CH Tax Credit, at the lowest credit rate of 15 per cent.

b. Carbon capture, utilization, and storage investment tax credit

Following consultations in August 2022, the Department of Finance has included additional criteria and elements for the CCUS ITC with legislative proposals to follow in 2023. The CCUS ITC will be retroactive and can be claimed starting on January 1, 2022, for eligible expenses. Under the updated design for 2023, dual use equipment (producing heat and/or power) will be treated as capture equipment and eligible for the CCUS ITC. Such dual-use equipment is only eligible where “the energy balance is expected to be used primarily to support the CCUS process or hydrogen production” eligible for the CH Tax Credit.

As CCUS technologies require storage, the CCUS ITC is only available where the equipment actually captures and stores CO2 emissions. The 2023 Budget reverses the 2022 announcement that required concrete storage methods to receive approval from Environmental and Climate Change Canada, instead, concrete storage requirements (being 60 per cent mineralization) is to be verified by an independent accredited organization.

Labour requirements are proposed as being applicable to the CCUS ITC. Details will be announced at a later date but will maintain an effective date of October 1, 2023.

c. Clean Technology Manufacturing Tax Credit

The Clean Technology Manufacturing Tax Credit (CT-MTC) is a 30 per cent refundable tax credit for companies that manufacture, extract, or process critical minerals and can be claimed on the capital cost of eligible property associated with eligible activities. The CT-MTC builds on the $3.8 billion for Canada’s Critical Mineral Strategy announced in 2022.

In addition to the CT-MTC, as part of its critical minerals strategy, the 2023 Budget has announced the ability for producers of lithium from brines to issue flow through shares under the Critical Mineral Exploration Tax Credit. This change will amend the Income Tax Act to include lithium from brines as an eligible resource and allow corporations to renounce expenses to investors who can then claim a 30 per cent non-refundable tax credit.

The Canadian tax system will serve as a key catalyst for the development of Canada’s critical minerals, which continues to be a targeted sector given its important in batteries, magnets, vehicles and electricity related technologies. Critical minerals mining sees overlap with the IRA given the need to strengthen supply-chains with global manufacturers. As the 2023 Budget notes: “The Buy North American provisions for critical minerals and electric vehicles in the IRA will create opportunities for Canada.”

d. Clean Electricity Tax Credit

The Clean Electricity Tax Credit (CETC) is a 15 per cent refundable tax credit for virtually any electricity generating investments that do not utilize fossil fuels (except for abated natural gas-fired electricity with some conditions) and includes transmission equipment, compressed air or hydroelectric storage, and batteries alongside more traditional systems involving wind, solar, hydro and nuclear electricity generation.

The CETC can be applied towards new or refurbished projects and will undergo additional consultation to determine whether it can be reciprocally applied under the IRA. This reciprocal IRA treatment is likely in response to the mandate of the Energy Transformation Task Force as announced on March 24, 2023 but in the meantime will be available to Crown-corporations, publicly owned entities, pension funds, and corporations owned by indigenous communities.

e. Nuclear Energy and Zero-Emission Technology Manufacturers

On the heels of the March 28 announcement that the provinces of Alberta, Saskatchewan, New Brunswick and Ontario have jointly signed an inter-provincial memorandum titled “A Strategic Plan for the Deployment of Small Modular Nuclear Reactors,” the 2023 Budget contains substantial corporate tax reductions.

The corporate income tax will be halved for companies engaging in nuclear manufacturing and processing activities and be treated at the same reduced rates as zero-emission technology manufacturers. Accordingly, the applicable general tax rate would be 7.5 per cent (rather than 15 per cent) and 4.5 per cent as the reduced small business tax rate. This expansion to include nuclear activities contemplates equipment, processing, recycling, and manufacturing of fuel rods.

Conclusion

In direct response to the IRA, investment in energy alternatives is a cornerstone to the 2023 Budget. The Canadian Government has announced it is ready to compete with the many incentives contained in the IRA and is banking on tax credits being able to hold the line against potential capital migration. The largest focus of these credits is the CETC with other key sectors including hydrogen production, critical mineral supply chain development, CCUS technology, and nuclear power.

For more information on the 2023 Budget and how it may impact you, please reach out to any of our key contacts listed below.

1 Inflation Reduction Act of 2022, Pub L No 117-169, 136 Stat 1818.

2 Ibid.

3 Credit Suisse, ESG Report, US Inflation Reduction Act – A tipping point in Climate Action.

4 Prime Minister Trudeau and President Biden Joint Statement | Prime Minister of Canada (pm.gc.ca)