ARTICLE

Land Owner Transparency Regulation – LOTA update and indirect control explained

Background

The Land Owner Transparency Act (LOTA) received royal assent on May 16, 2019. However, it was not until September 20, 2020 that the legislation was brought into force pursuant to Order in Council No. 549 and the regulatory requirements under the Land Owner Transparency Regulation (the Regulation) were made available.

The objects of LOTA are to “prevent tax evasion, fraud and money laundering”1 by increasing transparency in relation to land ownership. To achieve these objectives, LOTA requires all individuals who beneficially hold, directly or indirectly, an interest in land2 in British Columbia (whether through a relevant corporation, relevant partnership, or relevant trust) to be listed in a publicly searchable registry.3 For a more detailed analysis of LOTA requirements, please see our article here. The impacts of the Regulation are discussed below, along with anticipated impacts to transactions involving beneficial owners.

Key requirements

Effective November 30, 2020, LOTA requires that any time an application is made to register an interest in land in BC’s land title register, a transparency declaration4 must be filed to the LOTA Administrator by each transferee. If a transferee is a reporting body5 at the time of filing, it must also complete and file a transparency report6 setting out information about the reporting body and its interest holders.7 Transparency declarations and reports must be certified to be correct and complete by an individual who has actual knowledge of the matters certified and who has the authority to certify the declaration on behalf of the reporting body.8

LOTA requirements are applicable not only at the time of transfer, but apply in part to reporting bodies in existence as of November 30, 2020. Any reporting body holding a beneficial interest in land registered in the Land Title Office, and in existence at the time LOTA comes into effect, must file a transparency report by November 30, 20219,10, if the interest is not transferred before that date, detailing its ownership structure and identifying its interest holders. Although the foregoing requirements were set forth in LOTA, the Regulation has clarified the timelines for compliance.

Scope of regulation

After LOTA was adopted, one concern for clients has been: how far up the chain of beneficial ownership must a transferee must go to provide sufficient information in satisfaction of LOTA’s requirements?

That question partly turned on the meaning of the undefined terms “indirect control” and “control” in relation to what constitutes a “partnership interest holder” or “corporate interest holder” (each an interest holder) for the purposes of LOTA reporting requirements. The Regulation expands on LOTA by providing those definitions, among other things.

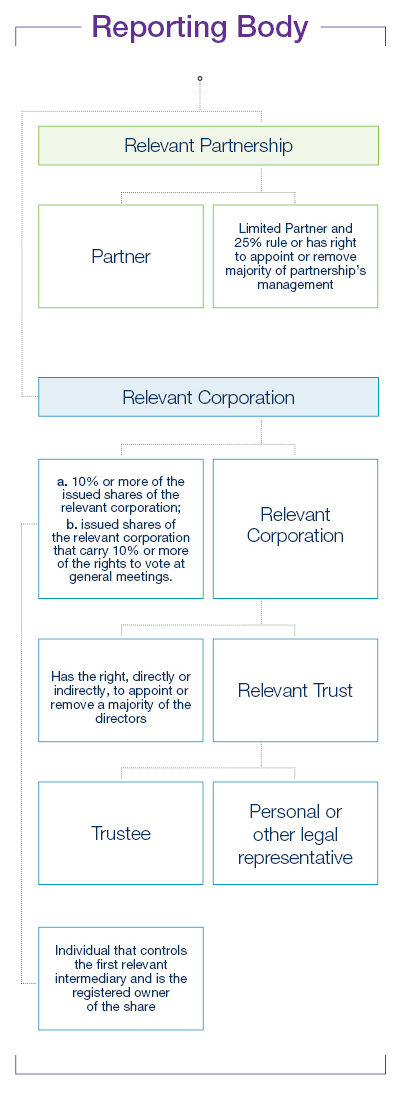

In particular, the meaning of “corporate interest holder” as set out in section 3 of LOTA is expanded by clarifying the meaning of “indirect control” as applied to shares, directors, and trustees. The Regulation also clarifies the meaning of “control” as applied to trustees and personal representatives. We have provided a graphic below as an example to explain the extent of the interest holder reporting requirements.

Indirect control of shares

The Regulation determines that indirect control of shares by individuals will trigger reporting requirements under LOTA in two cases. First, by requiring disclosure of an individual who is not a relevant intermediary and that has control of a relevant intermediary that is the registered owner of the share(s), and second, by extending the reporting requirements under LOTA up the “chain of relevant intermediaries” until a relevant corporation, partnership, trust, or individual is encountered that is not directly or indirectly controlled by another individual. Similar provisions apply to indirect control of shares by trustees.11

Indirect control of directors

The Regulation provides guidance as to the meaning of “indirect control” by an individual, trustee, or partnership of directors of a relevant corporation, trust, or partnership12 in Division 3 of the Regulation. In this context, LOTA provides that indirect control extends up the chain of intermediaries, and triggers reporting requirements when:

- for the purposes of indirect control by individuals:

- the individual controls a relevant intermediary who has the right to elect, appoint or remove a director of a relevant corporation; or

- the individual controls the first relevant intermediary in a chain of relevant intermediaries and the last relevant intermediary in the chain has the right to elect, appoint or remove the director, and

- for the purposes of indirect control by a trustee of a relevant trust, the individual is a trustee of a relevant trust, or a personal or other legal representative and the last relevant intermediary in the chain has the right to elect, appoint, or remove the director.

Control over trustees and personal representatives

The Regulation follows a similar approach in defining “control” of a trustee of a relevant trust, or “control” of a personal or other legal representative of a relevant corporation by a person by providing that:

- a person controls the trustee of a relevant trust if:

- the person has power to direct how the trustee is to elect, appoint or remove a director of a relevant corporation; or

- the person has the power to direct how the trustee is to exercise its control over directing the relevant intermediary below the trustee pursuant to the trustee’s powers,

- a person controls a personal or other legal representative if:

- the person has the authority to direct a representative how to exercise its right to elect, appoint, or remove a director; or

- in the case of a personal or other legal representative that controls the relevant intermediary below the representative, the person has the legal authority to direct how that representative is to exercise control over that relevant intermediary.

Future concerns

When LOTA was enacted, there was much speculation about the potential application of the new legislation. One theory that the Regulation has proven true is that the Province would use the LOTA Registry for enforcement of other provincial tax legislation, such as property tax exemptions under the Home Owner Grant Act and tax deferments under the Land Tax Deferment Act.13 We foresee that investigative searches using the Registry to apply the Speculation and Vacancy Tax Act or determine if additional property transfer tax is payable by foreign entities under the Property Transfer Tax Act may be employed at a later date.

For lawyers, the Regulation imposes additional record keeping requirements and presents an avenue for seizure of records that could require a lawyer to obtain a court order in order for the standard protection of solicitor-client privilege to apply to confidential client information.14

Although not directly created by the legislative language, an unavoidable prohibition on filing an application for registration arises if the necessary information for every interest holder is unknown or unobtainable. Best practice suggests that at the time of incorporation, merger, or partnership or trust formation, clients should determine the scope of information required by LOTA in anticipation that the information will be required for a future closing. Proactive information gathering will pre-empt last minute amendments to closing documents and potential defaults for failure to close on time.

Conclusion

As the first registry of its kind in Canada, LOTA is ambitious and reflects the policy objectives of the current government. Clients with complex reporting requirements will be required to disclose all levels of ownership of any property in BC with concurrent increases in legal costs and administrative burdens in relation to real estate closings.

Disclosure of information required by LOTA must be accurate and complete to avoid hefty penalties. Lawyers must encourage their clients to fully comply, not only due to our ethical obligations to adhere to the law, but also given the very real possibility that a lawyer’s confidential files may be seized without warning.

To avoid penalties and delays in closing, we suggest clients implement protocols to gather the necessary information for reporting pursuant to LOTA. If you are a reporting body with a registered beneficial interest in land, you must comply with these requirements by November 30, 2021, notwithstanding that you may not anticipate registering an interest in land before that time. For a further discussion of the implications of LOTA, please contact the members of our Commercial Real Estate team.

1 Land Owner Transparency Act White Paper: Draft Legislation with Annotations, Ministry of Finance, Province of British Columbia, June 2018, page i.

2 LOTA s. 1: “interest in land” means the following: (a) an estate in fee simple; (b) a life estate in land; (c) a right to occupy land under a lease that has a term of more than 10 years; (d) a right under an agreement for sale to (i) occupy land, or (ii) require the transfer of an estate in fee simple; (e) a prescribed estate, right or interest.”

3 Subject to applicable exclusions as listed in Schedule 1-2 of LOTA.

4 LOTA s. 1: A declaration that is filed by each transferee together with an application to register an interest in land, stating whether the transferee is a reporting body and, if the transferee is a reporting body, whether the reporting body is a relevant corporation, a trustee or a relevant trust, or a partner of a relevant partnership.

5 LOTA s. 1: A relevant corporation, a trustee of a relevant trust or a partner of a relevant partnership that is required to file a transparency report under LOTA.

6 Now including a serial number pursuant to s. 17-18 and 20 of the Regulation.

7 LOTA s. 1: A trustee of a relevant trust, a corporate interest holder of a relevant corporation, or a partner of a relevant partnership.

8 LOTA, s. 25(1).

9 Regulation, s. 19.

10 See exemptions for leases in Regulation, s. 21.

11 Regulation, s. 6.

12 As set out in section 3(2)(b)(ii) of LOTA.

13 Regulation, s. 22.

14 Regulation, Part 5.

- By: Emily McClendon, Matthew Tolan, Serge Lakatos

Key Contacts

-

Serge Lakatos

Partner

Services

- Commercial Real Estate

- Leasing

- Real Estate Investments

- Real Estate Project Development

- Real Estate Lending & Financing

- [See more on full bio]